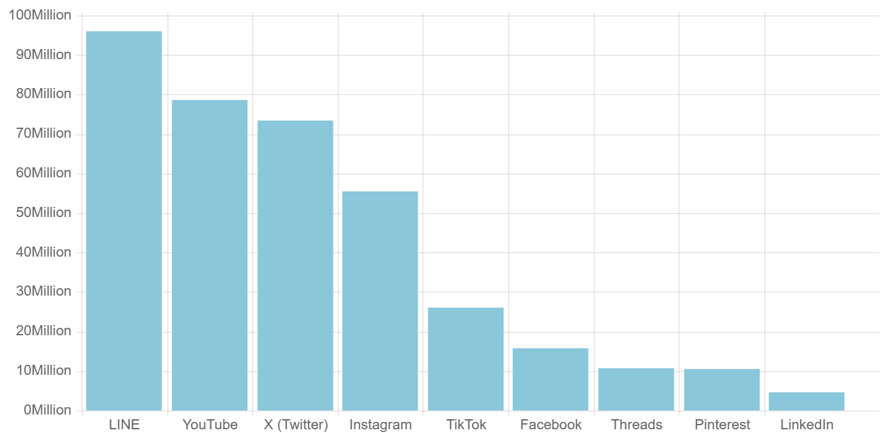

Now that we are already in 2025, Japan’s social media landscape is rapidly evolving, merging established platforms with emerging, dynamic networks. With a total population of approximately 123 million, each platform caters to unique demographics and serves distinct needs within the digital ecosystem. In this blog, we will explore the leading social media platforms that are defining Japan’s digital landscape this year.

LINE

LINE dominates Japan’s digital landscape, engaging over 78.7% of the total population, with more than 97 million monthly active users, female users being 53.3% and male users are around 46.7%. This widespread usage makes it a key platform for both personal communication and business interactions. Beyond its core function as a messaging tool, LINE has evolved into an all-encompassing platform for both personal and professional use. It seamlessly integrates instant messaging, video calls, mobile payments via LINE Pay, news, and entertainment, positioning itself as a central hub for daily life. This unique blend of communication, commerce, and entertainment has solidified LINE’s dominance as the go-to social platform in Japan.

YouTube

YouTube enjoys immense popularity in Japan, with an estimated 73.7 million monthly active users and projections suggesting this number will grow to 78.7 million. The platform serves as a dynamic hub for a wide array of video content, including education, fashion, gaming, beauty, news, anime, and comedy, playing a pivotal role in shaping social media trends across the country. With 90% of Japanese internet users accessing YouTube, it remains the leading platform for video consumption.

Instagram remains a dominant force in Japan, captivating 49.9% of internet users.

With approximately 55.45 million users, Instagram leads as Japan’s premier photo and video-sharing platform. It is especially popular among younger and middle-aged generations, who use it for both personal expression and celebrity engagement.

Locally, Instagram serves as a platform for users to follow their favorite influencers, connect with like-minded individuals, and discover new content. Its emphasis on visual storytelling, coupled with detailed captions, makes it a powerful tool for targeted advertising and consumer engagement.

TikTok

TikTok has firmly established itself as the go-to platform for short-form content, particularly among Japan’s younger demographic. With 26.05 million active adult users reaching 24.7%, TikTok thrives on its ability to deliver quick, entertaining content through viral trends and creative challenges. The platform has fostered the rise of a new wave of digital influencers, enabling everyday users to gain celebrity status overnight.

X (Formerly Twitter)

X (formerly Twitter) continues to be a vital platform for real-time information, maintaining its relevance amid growing competition from other social media networks. With 67- 72 million active users, reaching to 70.3%, X remains the go-to source for breaking news, live event coverage, and public discussions. Whether it’s political updates, natural disasters, or global events, users rely on X for immediate reactions and timely information.

As of January 2025, according to NapoleonCat, Facebook in Japan has 26 million users, with a strong focus on business networking rather than personal connections. The advertising reach to 12-16 million users.

For brands, Facebook is a valuable B2B channel, offering effective promotional and paid advertising opportunities to establish a presence in the Japanese market. The platform’s emphasis on real names enhances trust, making it a key tool for credible reviews and influencing consumer purchasing decisions.

While LinkedIn has not achieved the widespread popularity of other platforms in Japan, it remains a powerful tool for professional networking and career development. As of 2025, LinkedIn in Japan is expected to have around 4.0 – 4.1 million users, covering 3.3 -3.9% of the total population. While this number still represents a smaller portion of the overall social media user base in Japan, LinkedIn continues to grow steadily. It remains the leading platform for professional networking, B2B marketing, and recruitment in Japan, particularly popular among executives, entrepreneurs, and business professionals.

Conclusion

In 2025, Japan’s social media ecosystem showcases a diverse digital landscape. LINE and YouTube continue to dominate as the primary platforms for communication and content consumption. Meanwhile, Instagram and TikTok capture the attention of younger audiences with their focus on visual and short-form content. Despite the rise of newer platforms, X (formerly Twitter) and Facebook remain relevant in niche markets, particularly for real-time news and professional networking. For brands and individuals aiming to engage with Japanese audiences, understanding the unique role of each platform is crucial to crafting targeted and effective strategies.

In short, updated numbers reflect LINE (~97 MAU), YouTube (~78 MAU), Instagram (~55 MAU), TikTok (~26 MAU), X (~67 MAU), Facebook (~26 MAU), LinkedIn (~4 MAU)

Source: Statista, LINE, NapoleonCat, DataReportal (Japan’s Top Social Media Platforms for 2025 – 10th Edition – Humble Bunny)

Key notes

- MAU = Monthly Active Users (NapoleonCat / JapanBuzz data)

- Advertising Reach = Users eligible on advertising tools, typically lower than MAU

- Sources are from mid‑2025 reports (Digital Marketing for Asia, NapoleonCat, JapanBuzz)

About Our Services, Please Click Here

B2B Services | B2B Marketing Company in Japan | I&D↗